In the course of doing business, we will collect non-public, personal information about our clients. This information will never be disclosed to anyone, except as required by law.

Access to non-public, personal and account information is protected by physical, electronic, and procedural safeguards. These safeguards will be maintained in compliance with Federal standards regarding such information. It will be seen only by the staff who need to know in order to service your account.

The information we collect may come from the following sources:

The Gramm-Leach-Billey Act protects the personal and business information that is handled by our office. Your accountant and anyone else who provides financial services is required to disclose their policy regarding privacy and confidentiality.

How does this effect you? It really doesn’t. Our services won’t change. We are committed to retaining your confidence, and want to assure you that any information you provide us remains safe and confidential.

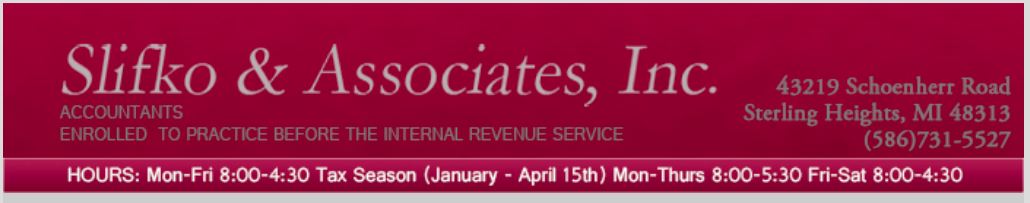

If you have any questions concerning this policy, please feel free to contact us at 586.731.5527.